In brief

Recently, China imposed a mandate on automakers requiring that electric vehicles (EVs) make up 40% of all sales by 2030. According to a series of MIT analyses, this move will expand the production of EVs and EV batteries enough to bring down the worldwide cost of both. Within China, annual sales of all vehicles will drop temporarily and then resume growing. The market share of EVs will expand as mandated, but many models will remain more expensive than their gasoline-powered counterparts. Between 2021 and 2030, the transition cost to China’s society could equal 0.1% of the nation’s growing gross domestic product every year. In a follow-on study, the researchers are finding that the benefits of the mandated move to EVs—for air pollution, human health, climate change, and national security—may be large enough to offset the cost.

In recent decades, China’s rapid economic growth has enabled more and more consumers to buy their own cars. The result has been improved mobility and the largest automotive market in the world—but also serious urban air pollution, high greenhouse gas emissions, and growing dependence on oil imports.

To counteract those troubling trends, the Chinese government has imposed policies to encourage the adoption of plug-in electric vehicles (EVs). Since buying an EV costs more than buying a conventional internal combustion engine (ICE) vehicle, in 2009 the government began to provide generous subsidies for EV purchases. But the price differential and the number of buyers were both large, so paying for the subsidies became extremely costly for the government.

As a result, China’s policy makers will phase out the subsidies by the end of 2020 and instead rely on a mandate imposed on car manufacturers. Simply stated, the mandate requires that a certain percent of all vehicles sold by a manufacturer each year must be battery-powered. To avoid financial penalties, every year manufacturers must earn a stipulated number of points, which are awarded for each EV produced based on a complex formula that takes into account range, energy efficiency, performance, and more. The requirements get tougher over time, with a goal of having EVs make up 40% of all car sales by 2030.

This move will have a huge impact on the worldwide manufacture of EVs, according to William H. Green, the Hoyt C. Hottel Professor in Chemical Engineering. “This is one of the strongest mandates for electric cars worldwide, and it’s being imposed on the largest car market in the world,” he says. “There will be a gigantic increase in the manufacture of EVs and in the production of batteries for them, driving down the cost of both globally.”

But what will be the impact of the mandate within China? The transition to EVs will bring many environmental and other benefits. But how much will it cost the nation? In 2016, chemical engineering colleagues Green and then-graduate student I-Yun Lisa Hsieh PhD ’20 decided to find out. Their goal was to examine the mixed impacts of the mandate on all affected factors: battery prices, manufacturing costs, vehicle prices and sales, and the cost to the consumer of owning and operating a car. Based on their results, they could estimate the total societal cost of complying with the mandate in the coming decade.

Looking at battery prices

“The main reason why EVs are costly is that their batteries are expensive,” says Green. In recent years, battery prices have dropped rapidly, largely due to the “learning effect”: As production volumes increase, manufacturers find ways to improve efficiency, and costs go down. It’s generally assumed that battery prices will continue to decrease as EVs take over more of the car market.

Using a new modeling approach, Green and Hsieh determined that learning effects will lower costs appreciably for battery production but not much for the mining and synthesis of critical battery materials. They concluded that the price of the most widely used EV battery technology—the lithium-ion nickel-manganese-cobalt battery—will indeed drop as more are manufactured. But the decline will slow as the price gets closer to the cost of the raw materials in it.

Using the resulting estimates of battery price, the researchers calculated the extra cost of manufacturing an EV over time and—assuming a standard markup for profit—determined the likely selling price for those cars. In previous work, the researchers had used a variety of data sources and analytical techniques to determine “affordability” for the Chinese population, in other words, the fraction of their income available to spend on buying a car. Based on those findings, they examined the expected impact on car sales in China between 2018 and 2030.

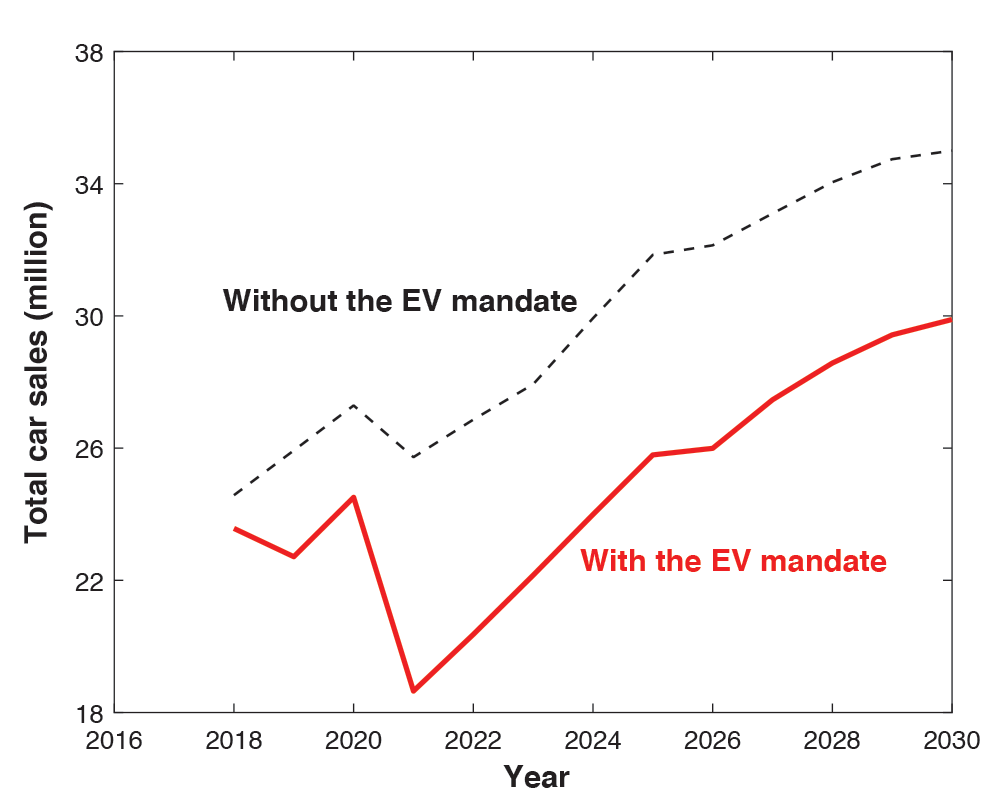

Projected car sales in China without and with the electric vehicle (EV) mandate The black dashed curve shows projected car sales assuming no EV mandate. The decline in 2021 is due to new emissions and fuel economy standards adopted in 2020. The solid red curve shows projected car sales with the mandate. Total car sales drop in 2021 due to the elimination of EV subsidies and then grow again as consumer incomes rise.

Their results are shown in the figure above. As a baseline for comparison, the researchers first assumed a “counterfactual” (not true-to-life) scenario—here, car sales without significant adoption of EVs, so without the new mandate. As the dashed black curve shows, under that assumption, annual projected car sales climb to more than 34 million by 2030. (The drop in 2021 is a response to higher prices due to new emissions and fuel economy standards in 2020.)

The solid red curve shows what happens when the subsidy on EV purchases is eliminated and the mandate is enacted in 2020. Total car sales shrink in 2021 after the subsidies are eliminated. But thereafter, the growing economy and rising incomes increase consumer purchasing power and drive up the demand for private car ownership. Annual sales are on average 20% lower than in the counterfactual scenario, but they’re projected to reach about 30 million by 2030.

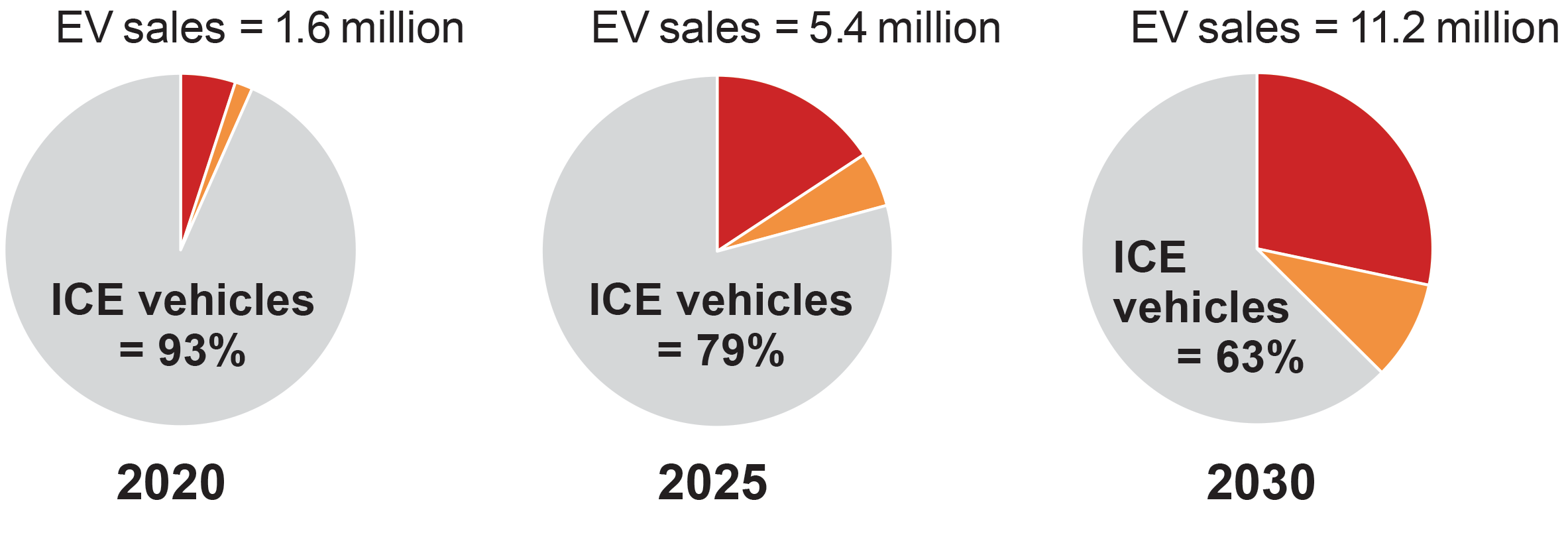

The pie charts below show the breakdown in projected sales between ICE vehicles and battery EVs at three points in time. In 2020, EVs make up just 7% of the total (1.6 million vehicles). By 2025, that share is up to 21% (5.4 million). And by 2030, it’s up to 37% (11.2 million)—close to the government’s 40% target. Altogether, 66 million EVs are sold between 2020 and 2030.

Makeup of projected vehicle sales at three points in time on the red curve above These pie charts show the split in projected sales among the three vehicle types: ICE vehicles (gray), hybrid EVs (orange), and pure battery EVs (red). The total number of number of EVs sold is indicated for each year.

Two types of plug-in EVs are indicated by color: Red represents pure battery EVs, and orange represents hybrid EVs (which are powered by both batteries and gasoline). About twice as many pure battery EVs are sold than hybrid EVs, even though the former are more expensive due to the higher cost of their batteries. “The mandate includes a special preference for cars with a longer range, which means cars with large batteries,” says Green. “So carmakers have a big incentive to manufacture the pure battery EVs and be awarded extra points under the mandate formula.”

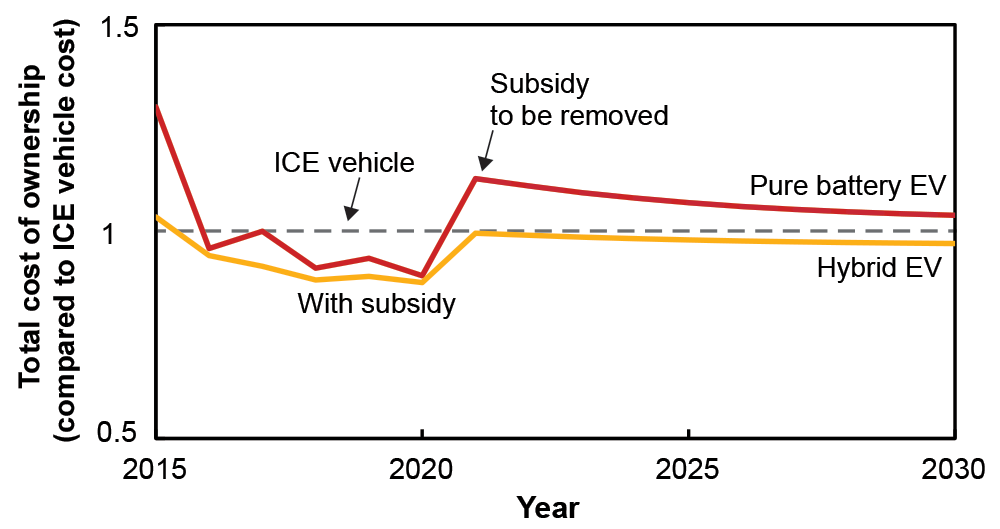

For the consumer, the added cost of owning an EV includes any difference in vehicle expenses over the whole lifetime of the car. To calculate that difference, the researchers quantified the “total cost of ownership,” or TCO, including the purchase cost, fuel cost, and operating and maintenance costs (including insurance) of their two plug-in EVs and an ICE vehicle out to 2030. The figure below shows how the costs of the pure battery EV and the hybrid EV compare to the cost of an ICE vehicle. The horizontal rule at 1 indicates that the costs are the same, so “at parity.”

From 2016 to 2020, both types of EVs benefit from the electric vehicle subsidy, so the TCO of each is less than that of an ICE vehicle. Substantial cuts in the pure battery EV subsidy in 2017 and 2019 cause the two rises in that curve, and the total elimination of the subsidies causes a major uptick in both EV curves in 2020. TCO parity remains for the hybrid EV out to 2030, but parity isn’t achieved for the pure battery EV even by 2030, though it gets closer due to the expected decline in battery prices.

Total cost in China of owning an EV compared to an ICE vehicle over the lifetime of the car Before 2020, owning either type of plug-in EV is less costly than owning an ICE vehicle due to the subsidy paid on EV purchases. After the subsidy is removed and the mandate imposed in 2020, owning a hybrid EV (orange curve) is comparable to owning an ICE vehicle. Owning a pure battery EV (red curve) is more expensive due to its high-cost batteries. Dropping battery prices reduces total ownership cost for both types of EVs, but the pure battery EV remains more expensive out to 2030.

Cost to society

The next step for the researchers was to calculate the total cost to China of forcing the adoption of EVs. The basic approach is straightforward: The researchers take the extra TCO for each EV sold in each year, discount that cost to its present value, and multiply the resulting figure by the number of cars sold in that year. (They exclude taxes embedded in the purchase prices of the vehicle, of electricity and gasoline, and so on, as the society will have to pay other taxes to replace that lost revenue.)

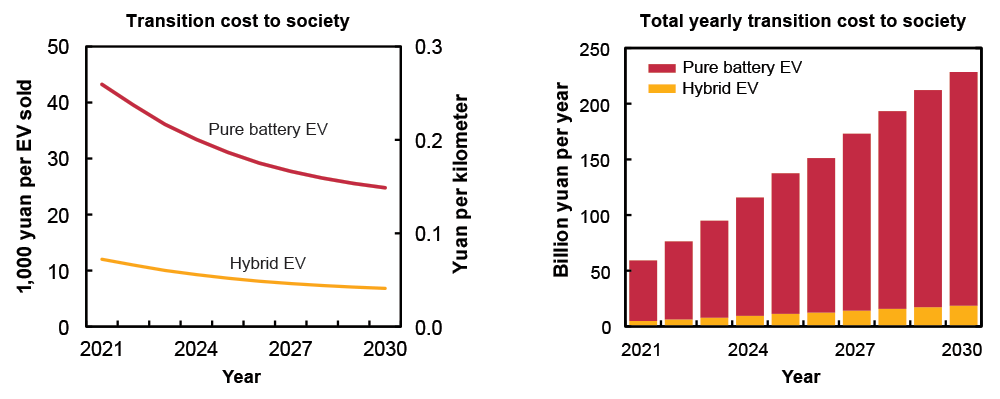

Transition cost to society Left: The per-vehicle incremental cost of owning and driving an EV decreases from 2021 to 2030. The cost declines more for pure battery EVs than for hybrid EVs, but the former remain more costly. Right: Each bar represents the total cost of transitioning to EVs in a single year. The red represents pure battery EVs and the orange, hybrid EVs. The total number of EVs sold in a year more than offsets any decrease in per-vehicle cost, so the incremental cost to society grows.

Their results appear above. The left-hand figure shows the incremental cost to society of each EV sold in a given year (left axis) and the extra cost per kilometer driven (right axis). The cost assumes that the vehicle has a lifetime of 12 years and is driven 12,500 kilometers each year. Again, the pure battery EV curve is higher than the hybrid EV curve, and both decline over time as battery costs decrease.

The right-hand figure combines that per-car cost to society with the number of cars sold, revealing the total extra cost incurred. Each bar represents a single year, and the red represents pure battery EVs, the orange, hybrid EVs. The chart shows that the number of EVs sold annually will increase faster than the cost per vehicle will drop, so the annual incremental cost to society will keep growing. And the cost is sizeable. On average, the transition to EVs forced by the mandate will cost 100 billion yuan per year from 2021 to 2030, which is about 2% of the nationwide expenditure in the transport sector every year.

During the 10 years from 2021 to 2030, the annual societal cost of the transition to almost 40% EVs is equivalent to about 0.1% of China’s growing gross domestic product. “So the cost to society of forcing the sale of EVs in place of ICE vehicles is significant,” says Hsieh. “People will have far less money in their pockets to spend on other purchases.”

Other considerations

Green and Hsieh stress that the high societal cost of the forced EV adoption must be considered in light of the potential benefits to be gained. For example, switching from ICE vehicles to EVs will lower air pollution and associated health costs; reduce carbon dioxide emissions to help mitigate climate change; and reduce reliance on imported petroleum, enhancing the country’s national energy security and balance of payments.

Hsieh is now working to quantify those benefits so that the team can perform a proper cost-benefit analysis of China’s transition to EVs. Her initial results suggest that the monetized benefits are—like the costs—substantial. “The benefits appear to be the same order of magnitude as the costs,” she says. “It’s so close that we need to be careful to get the numbers right.”

The researchers cite two other factors that may impact the cost side of the equation. In early 2018, six Chinese megacities with high air pollution began restricting the number of license plates issued for ICE vehicles and charging high fees for them. With their lower-cost, more-abundant “green car plates,” EVs became cost-competitive, and sales soared. To protect Chinese carmakers, the national government recently announced that it plans to end those restrictions. The outcome and its impacts on EV sales remain uncertain.

The second caveat concerns how carmakers price their vehicles. The results reported here assume that prices are calculated as they are today: the cost of manufacturing the vehicle plus a certain percentage markup for profit. With the new mandate in place, automakers will need to change their pricing strategy so as to persuade enough buyers to purchase EVs to reach the required fraction. “We don’t know what they’re going to do, but one possibility is that they’ll lower the price of their battery cars and raise the price of their gasoline cars,” says Green. “That way, they can still make their profits while operating within the law.” As an example, he cites how U.S. carmakers responded to Corporate Average Fuel Economy standards by adjusting the relative prices of their low- and high-efficiency vehicles.

While such a change in Chinese automakers’ pricing strategy would lower the price of EVs, it would also push up average car prices overall, because the total car sales mix is dominated by ICE vehicles. “Some people in China who would otherwise be able to afford a cheap gasoline car now won’t be able to afford it,” says Hsieh. “They’ll be priced out of the market.”

Green emphasizes the impact of the mandate on all carmakers worldwide. “I can’t overstate how hugely important this is,” he says. “As soon as the mandate came out, carmakers realized that electric vehicles had become a major market rather than a niche market on the side.” And he believes that even without subsidies, the added expense of buying an EV won’t be prohibitive for many car buyers—especially in light of the benefits they offer.

However, he does have a final concern. As more and more EVs are manufactured, global supplies of critical battery materials will become increasingly limited. At the same time, however, the supply of spent batteries will increase, creating an opportunity to recycle critical materials for use in new batteries and simultaneously prevent environmental threats from their disposal. The researchers recommend that policy makers “help to integrate the entire industry chain among automakers, battery producers, used-car dealers, and scrap companies in battery recycling systems to achieve a more sustainable society.”

This research was supported through the MIT Energy Initiative’s Mobility of the Future study. William H. Green is co-director of MITEI’s Mobility Systems Center. In autumn 2020, I-Yun Lisa Hsieh PhD ’20 joined the faculty of the National Taiwan University as an assistant professor. More information about this research can be found in:

I-Y.L. Hsieh and W.H. Green. “Transition to electric vehicles in China: Implications for total cost of ownership and cost to society.” SAE International Journal of Sustainable Transportation, Energy, Environment, & Policy, 2020. Online: doi.org/10.4271/13-01-02-0005

I-Y.L. Hsieh, P.N. Kishimoto, and W.H. Green. “Incorporating multiple uncertainties into projections of Chinese private car sales and stock.” Transportation Research Record, 2018. Online: doi.org/10.1177/0361198118791361

I-Y.L. Hsieh, M.S. Pan, Y.-M. Chiang, and W.H. Green. “Learning only buys you so much: Practical limits on battery price reduction.” Applied Energy, no. 239, pp. 218–224, 2019. Online: doi.org/10.1016/j.apenergy.2019.01.138

I-Y.L. Hsieh, M.S. Pan, and W.H. Green. “Transition to electric vehicles in China: Implications for private motorization rate and battery market.” Energy Policy, vol. 144, 111654, 2020. Online: doi.org/10.1016/j.enpol.2020.111654

This article appears in the Autumn 2020 issue of Energy Futures.