In Brief

An MIT researcher has produced step-by-step guidelines for performing high-stakes negotiations that succeed—even after decades of mistrust, confrontation, and deadlock. One case study in his award-winning research—now published in a new book—focused on negotiations that resolved a 70-year dispute between Mexico and the United States over hydrocarbon reservoirs that cross the countries’ maritime boundary in the Gulf of Mexico. By interviewing participants and experts on both sides, he identified practices and strategies that all viewed as critical to producing a ground-breaking agreement. One key was a firm commitment by leaders of both countries, across diverse political leanings, to empower their negotiation teams to replace the usual win-lose mentality with an approach focused on joint fact-finding. Also important to crafting a mutually beneficial, robust agreement were commitments to build trust and reciprocity, creatively assess each other’s goals and constraints, break traditional protocol to involve a wider array of stakeholders, and issue joint public communications that focus not on conflict but on the merits of coordination and gains for all.

When people think of high-stakes negotiations—whether between countries or interest groups or individuals—they generally picture raised voices and table pounding as each side competes to get an outcome that’s in its best interest. But research and experience suggest that a different approach may ensure a more efficient process and a better result.

“There’s evidence that one of the best ways to satisfy one’s own interests is to find an effective way to meet the core interests of the other side,” says Bruno Verdini PhD ’15, lecturer in urban planning and negotiation and executive director of the MIT-Harvard Mexico Negotiation Program. “Embracing a mutual-gains approach to negotiation implies switching away from the traditional, widespread, zero-sum, win-lose mindset in order to structure the negotiation process instead as an opportunity for stakeholders to learn about and respond to each other’s core needs. The result tends to be a more robust agreement that both sides experience and view as beneficial.”

Experts have come up with independent theories about how to enhance adaptive leadership, collaborative decision-making, political communication, and dispute resolution in communities. Verdini wanted to integrate those theories for the first time and apply them to the realm of natural resource management, exploring what had happened in real situations where stakes were high.

To that end, he decided to examine two long-running disputes between the United States and Mexico regarding shared natural resources—hydrocarbon reservoirs in the Gulf of Mexico and environmental and water resources from the Colorado River. In both cases, after seven decades of stalemate, the countries came up with joint agreements in 2012. Since then, both deals have been implemented, enhanced, and renewed for the foreseeable future, despite changes in the binational political landscape over the past few years.

The energy dispute

Defining the rules for deep-water energy production along the US-Mexico maritime boundary had been a source of contention for some 70 years. Within 200 nautical miles from either coastline, ownership is clear. But in the middle of the hydrocarbon-rich Gulf of Mexico, the question remained: How do the US and Mexico engage with each other to address the potential for reservoirs straddling the boundary?

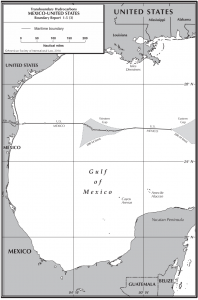

The maritime boundary in the Gulf of Mexico The solid line across the Gulf of Mexico on this map indicates the international maritime boundary between the United States and Mexico, including two submerged areas of continental shelf that extend beyond the 200 nautical-mile exclusive economic zones of Mexico and the United States, known as the Western Gap and Eastern Gap. A binational agreement reached in 2012 is structured to incentivize US international energy companies and Petróleos Mexicanos (PEMEX), Mexico’s national oil company, to jointly explore, discover, and produce from offshore transboundary reservoirs straddling the 550-nautical-mile-long maritime boundary. The deal establishes the legal and market framework to form partnerships within 15 nautical miles on either side, an area equal in size to three times the state of Massachusetts. Source: US Department of State

For decades, the notion of US and Mexican energy companies working together didn’t seem feasible. The US adhered to the “rule of capture,” which asserts that if a company drills into a reservoir on the US side, regardless of whether the reservoir crosses the border, it owns all of the extracted oil: first-come, first-served. Mexico argued that this unilateral behavior was not fair, but since it had strict constitutional rulings forbidding joint drilling between international energy companies and Petróleos Mexicanos (PEMEX), its national oil company, cooperation seemed unlikely. In 2000, stuck at an impasse, the two countries agreed to place a decade-long moratorium on drilling in the contested area.

In 2010, the US and Mexico agreed to extend that moratorium for another four years, but this time, they had a new plan in the works. By 2012, after less than 18 months at the negotiating table, the two sides had signed a landmark agreement that would overhaul all prior practices and incentivize US and Mexican companies to jointly develop shared hydrocarbon reservoirs—the first significant offshore energy partnership in the history of relations between the two countries. That agreement would later be complemented and further enhanced by a series of landmark domestic energy reforms in Mexico.

To understand that breakthrough, Verdini talked with the stakeholders from both countries who directly conducted the negotiations. “The idea behind the research was simply to learn from the people who were involved in those high-stakes negotiations,” he says. “The focus was not on the features of the agreement but on what they did day-to-day as they negotiated it. What kind of conversations did they set up? What kind of strategies did they follow to resolve these disputes?” Ultimately, his goal was to find out what actors from different organizations and backgrounds on both sides thought worked in practice.

To that end, he interviewed more than 70 individuals, including all key political leaders, such as presidents, secretaries, and ambassadors; CEOs as well as technical and scientific experts in industry; and general managers of environmental organizations. In those in-depth interviews, the US and Mexican negotiators unpacked the decisions and practices they thought transformed the negotiation process and product—allowing Verdini to piece together what both sides considered, unbeknownst to each other, as the key steps and strategies. He has synthesized this research in a new book, Winning Together: The Natural Resource Negotiation Playbook.

Flexible leadership, unusual first steps

As is the case with any window of opportunity, one factor shaping the start of negotiations was simply that conditions and attitudes had changed. Mexico’s production from onshore and shallow-water fields had declined sharply, and the country needed a new source of revenue. Promising new fields were mostly located in deep water, and Mexico needed access to a level of investment, risk-sharing, and technological expertise that would be possible only through international partnerships. While the US still supported the rule of capture, high-ranking US officials noted the potential benefits of cooperation, including opening up Mexico’s energy sector to foreign investment and improving US energy security, in tandem with positive impacts on Mexico’s economic and social stability. Thus, both sides wanted to end the moratorium on development—but they didn’t know how to go about it.

In spring 2010, when the presidents of the two countries publicly announced that they wanted an agreement and specified that they wanted it to be a mutual-gains solution, there was still no blueprint on how to bridge a whole host of divides. However, that unprecedented broad mandate, which had been years in the making, empowered high-level negotiators to take some unusual steps.

For example, several months before negotiations officially started, as per traditional diplomatic protocols, the Mexican authorities sent a draft agreement to the United States. The preliminary review by US agencies found that the draft contained hundreds of terms that the US was unlikely to accept. Typically, the next step would be for the US to send back a counterdraft presenting objections and suggestions, paragraph by paragraph—and the incessant draft–counterdraft cycle would begin.

However, the lead US negotiator—a lawyer in the US State Department who had first-hand experience working in the oil industry—recognized that such a negotiation pattern was doomed to failure because each side couldn’t fully know, at the outset, where the other was coming from, given fundamental differences in industry behavior, market incentives, and legal structures. He therefore suggested that before starting any face-to-face negotiations, the two groups of negotiators should launch a series of collaborative workshops to develop a deeper understanding of how each country operated in the Gulf of Mexico.

At first, the Mexican negotiators thought this step was merely a delay tactic by the US. Yet soon enough, as a result of time spent working side by side, all involved felt that those workshops—held monthly in different locations in the US and Mexico—proved critical. The Mexican and US participants learned about each other’s political, legal, and economic goals and constraints in a positive environment. Perhaps more important, they got to know one another personally and to build rapport. “So they had the opportunity to start sharing information in ways that they had never done before,” says Verdini. “And they were able to genuinely put themselves in the other side’s shoes and better appreciate their concerns and interests.”

Mismatched assumptions

An unprecedented move by Mexico broke down another barrier to progress, namely, differing assumptions about what was at stake in the dispute. Actors on the US side came into the negotiations claiming that the existence of cross-boundary reservoirs was doubtful—geological formations in the region tend to be tall and narrow—so there was little need for an agreement on how to manage them. Actors on the Mexican side argued that their existence was likely and feared that, without a joint agreement, conflict could erupt if companies drilled on one side, draining hydrocarbons in the shared reservoirs.

Finally, to break the impasse, leaders at the Mexican Ministry of Energy and PEMEX invited US government officials to PEMEX’s state-of-the-art, three-dimensional visualization center in Tabasco, where they were allowed to observe proprietary geological data that suggested why Mexico felt there were transboundary hydrocarbons. That action was a game-changer. It demonstrated how serious Mexico was about moving forward with negotiations and showcased the developing trust between the two sides.

To reciprocate, the United States hosted Mexican officials for presentations in New Orleans, providing details about the formal arrangements under which US companies forgo the rule of capture and sign unitization agreements to work with each other in the Gulf of Mexico. Those agreements allocate operating risks and revenues between coordinating parties and ultimately increase total output from a given reservoir. That information clarified that both sides were making strides to collaboratively address their common interests.

Protecting the process

As the negotiations unfolded, the US and Mexican leaders were increasingly committed to protecting the collaborative spirit of the negotiations—a spirit that was tested with some frequency. For example, on several occasions a politically well-connected figure from one side or the other would visit the negotiations and display a confrontational attitude. “When that happened, the operational leader on the side of the errant interloper would ask the other—through private conversation—not to pay mind to this behavior but rather let the person rant and then move on,” explains Verdini. Those unusual and reciprocal assurances kept the negotiation process from being derailed by ineffective tactics.

Early engagement of environmental leaders also enhanced the process. Typically, nongovernmental organizations (NGOs) would try to block any proposal to open up new acreage for offshore drilling. However, in proactive and frequent meetings with NGO advocates, the negotiators mapped out the realities of the scenario: Given its dwindling revenues, Mexico would surely drill more in the Gulf of Mexico. If both countries proceeded on their own, multiple wells on both sides of the maritime boundary would be drilled, increasing the likelihood of spills and mishaps. If instead a collaborative agreement were in place, US and Mexican partner companies would have access to the full geological picture. They could then share the most advanced technology and expertise on how to proceed, permitting drilling to occur on fewer, carefully selected, joint sites. That perspective—along with an innovative provision establishing a process for joint safety inspections—led the environmental NGOs to conclude that, while they could not advocate for passage of the agreement, they would not step in to oppose it.

Lecturer Bruno Verdini coaches undergraduates as they debrief a role-play negotiation session in 11.011 The Art and Science of Negotiation. The weekly simulations build on cases, discussions, and one-on-one meetings and empower students to put new communication, collaboration, and leadership strategies into practice. The class has become one of the most popular and highest-ranked electives at MIT. Photo: Tom Gearty, MIT

Communicating with the public

Another notable feature of the negotiations was the careful crafting of all public communications. Reports of high-stakes negotiations generally focus on conflict and mistrust—a unilateral message that engages readers and listeners on both sides but can hinder the process of reaching a mutual resolution. In this case, the two countries agreed to communicate through joint declarations—and to keep those to a minimum. Public releases focused on the real benefits to be seized together, a narrative that gave both sides “victory speeches” they could deliver to their stakeholders and constituents back home.

In addition, PEMEX devised a media campaign that—without mentioning the ongoing negotiations—stressed that production from the usual shallow offshore fields was diminishing and that getting the most out of promising new deepwater fields would require collaboration with international energy companies. The resulting tax revenues would fund pressing education, public health, and security initiatives.

Incentives rather than requirements

The incentives included in the agreement are a remarkable feature derived from the negotiation process itself, according to Verdini. One creative element is the mechanism the binational deal sets up for resolving conflicts. When partner companies are jointly developing a deepwater reservoir, new information can bring the initial allocation of ownership into question, and the partners may not agree on an appropriate redetermination. Mexico wanted such disputes to be settled by an international court, a proposal that for political reasons was unacceptable to the United States.

Working together, the negotiators came up with a dispute-resolution process unlike any other in transboundary deepwater agreements across the world. The process involves three steps: first, a dialogue between industry CEOs; next, mediation aided by neutral third parties; and finally, arbitration by impartial adjudicators who issue a nonbinding ruling. If there’s still no agreement, then either of the two governments can step in to stop production. But such a move would mean financial losses of hundreds of millions of dollars, given the investment costs of drilling wells—a strong incentive for the parties not to trigger disputes for mere political reasons and a creative way to reach a resilient agreement without binding resolutions.

Also striking is how the binational deal encourages companies to unitize. Mexico preferred mandated unitization, but the US wouldn’t accept such a mandate in light of the precedent it could set against the rule of capture in other parts of the world. That deadlock was broken by an arrangement that may seem surprising but actually demonstrates the deep mutual understanding of the negotiators.

If unitization seems impossible, a company can produce from a transboundary reservoir on its own. However, the agreement states that the company’s rights will be based on the estimated percentage of oil resources on its side of the maritime boundary, according to available seismic data—a risky undertaking because seismic estimates before drilling are often incorrect. In addition, it’s well known that producing from only one side of the maritime boundary will likely reduce overall recovery rates and thus profits. As a result, the side that begins production first inevitably damages not only the interests of the nonproducing party but also its own.

Since proceeding alone increases the likelihood of subpar outcomes from geological, business, and political perspectives, the agreement provides incentives for unitization without requiring it—an arrangement that’s politically feasible and implementable for both sides.

The playbook

Based on his research findings from the Gulf of Mexico and the Colorado River negotiations, as well as a larger review of transboundary water practices around the world, Verdini prepared a practical, step-by-step guide to high-stakes energy, water, and environmental negotiations between developed and developing countries. The guide is described in detail in his book and graphically represented below.

Based on his interviews and studies of other transboundary practices around the world, Verdini prepared a practical guide to performing high-stakes energy, water, and environmental negotiations. This infographic summarizes his step-by-step guide to success. Graphic: Jenn Schlick, MITEI

But identifying those steps was only part of the journey. Verdini now uses his innovative pedagogy in courses and workshops in which all participants— from government leaders and industry executives to students across disciplinary bounds—practice the strategies to further advance their interests without compromising on their principles.

In the end, Verdini wants to empower everyone to be an effective negotiator— as he says, “so you can sit down with someone who might be different from you, who might have different challenges and different priorities, and you can trust that, with these negotiation skills and strategies, you can work together to make the world a better place.”

Notes

This research was supported by the MIT Department of Urban Studies and Planning and the MIT Department of Political Science. Verdini received MIT’s first-ever interdisciplinary PhD in Negotiation, Communication, Diplomacy, and Leadership. The research is the recipient of Harvard Law School’s award for best research of the year in negotiation, mediation, and conflict resolution, the first time the honor has been awarded to faculty based at MIT. In partnership with several agencies in Mexico, Verdini is now heading the development of a binational negotiation center devoted to training stakeholders and organizations in different fields in the theory and practice of the mutual-gains approach to negotiation. Further information on his research can be found in:

B. Verdini. Winning Together: The Natural Resource Negotiation Playbook. The MIT Press, 2017.

This article appears in the Spring 2018 issue of Energy Futures.